Scarborough Businesses in the News

Disaster loans May 20, 2024 deadline

Friday, April 26, 2024

SBA Disaster Relief Programs

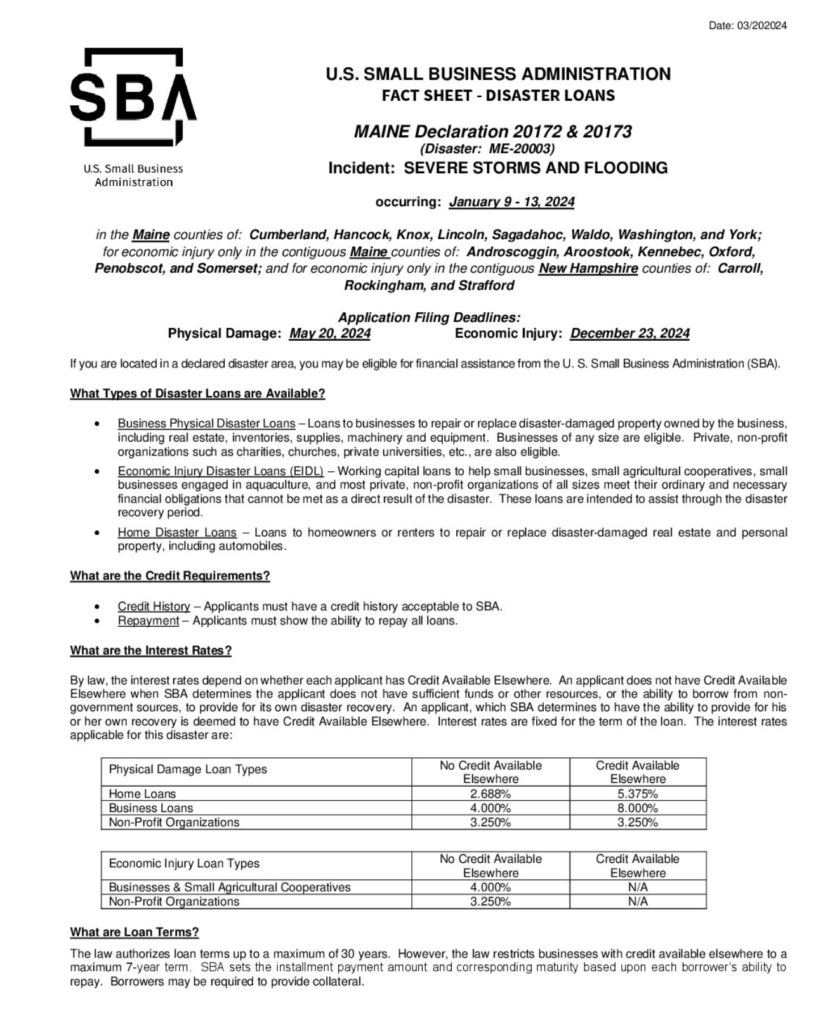

Several federal disaster relief programs became available to individuals and businesses in Scarborough as part of a disaster designation based on the recent storms and flooding. The programs have low interest rates and are definitely worth evaluation for your business or home. There is a May 20, 2024 deadline for physical damage and a December 23, 2024 deadline for economic injury.

According to the US Small Business Administration, the following programs are available.

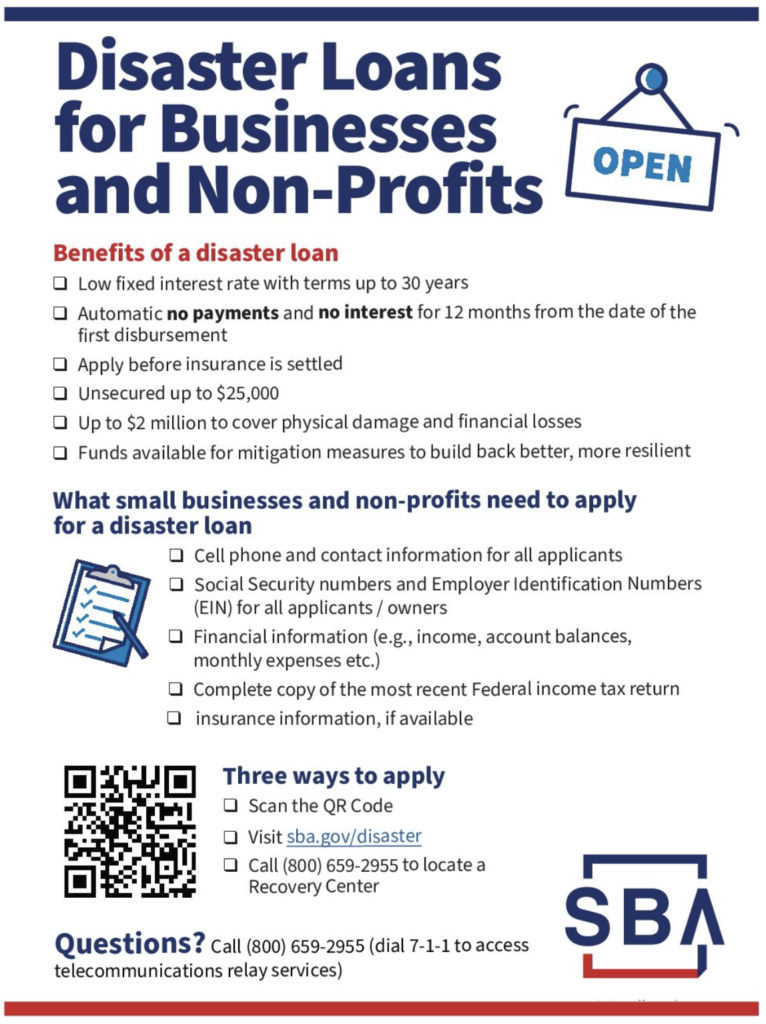

- Business Physical Disaster Loans – Loans to businesses to repair or replace disaster-damaged property owned by the business, including real estate, inventories, supplies, machinery and equipment. Businesses of any size are eligible. Private, non-profit organizations such as charities, churches, private universities, etc., are also eligible.

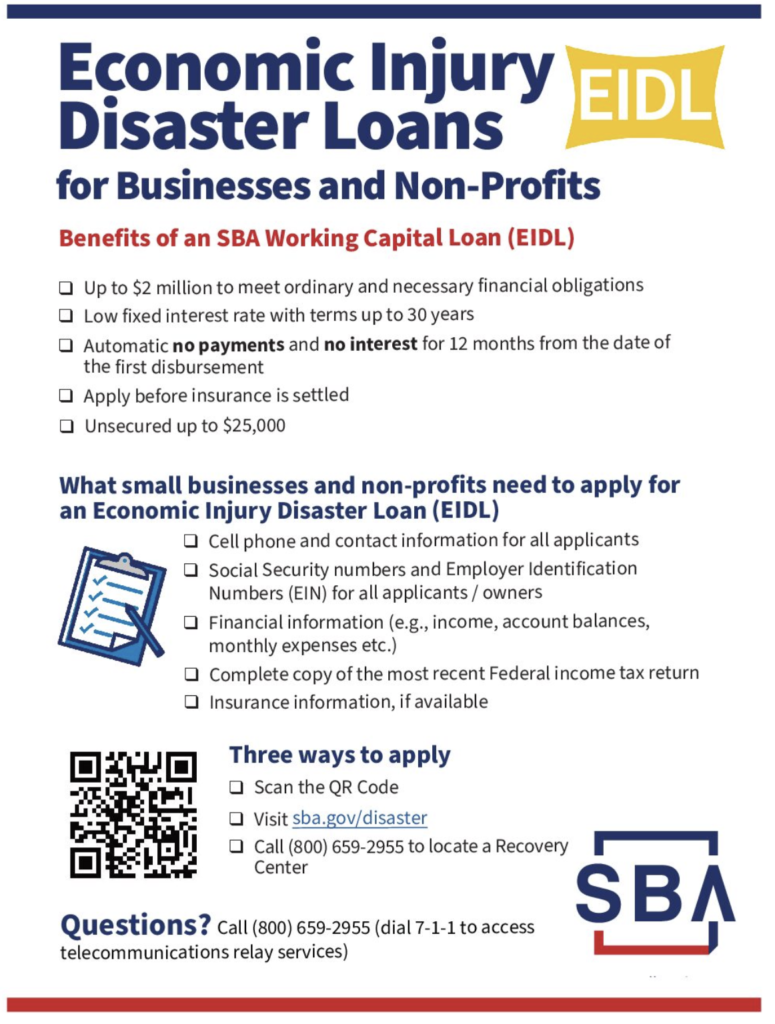

- Economic Injury Disaster Loans (EIDL) – Working capital loans to help small businesses, small agricultural cooperatives, small businesses engaged in aquaculture, and most private, non-profit organizations of all sizes meet their ordinary and necessary financial obligations that cannot be met as a direct result of the disaster. These loans are intended to assist through the disaster recovery period.

- Home Disaster Loans – Loans to homeowners or renters to repair or replace disaster-damaged real estate and personal property, including automobiles.

PLEASE take a look at the Fact Sheet to see allowable projects, interest rates and loan terms. The application process is reported to be fairly simple and you have options for how the loan is structured.

Applications can be submitted at https://lending.sba.gov.

Here is a summary of the programs from SBA:

The SBA Office of Disaster Recovery & Resilience works alongside FEMA when there is a Presidential Disaster Declaration, such as the flooding on January 10th and 13th.

The SBA offers low-interest, long-term loans to cover damages not covered by insurance, FEMA or another source.

- These loans are available to homeowners, renters, businesses of all sizes, and non-profit organizations that had storm or flooddamage from January 9-13, 2024.

- If you live in Cumberland, Hancock, Knox, Lincoln, Sagadahoc, Waldo, Washington or York County, and had physical damage to your home, personal property, business or non-profit, you can apply for a low-interest loan from the SBA.

- There is no cost to apply, and no interest or payments for the first year of the loan. And with no pre-payment penalties, if you pay off your loan in less than a year, you will not have to pay any interest.

- Even if you have already used a credit card or obtained a bank loan to pay for repairing your home or business, or to replace your business inventory or equipment, you can still get an SBA loan and replace that more expensive debt with a low-interest disaster loan from the SBA.

- After the first year with no interest or payments, the interest rate for most homeowners and renters is as low as 2.688%, for most businesses as low as 4%, and 3.25% for non-profits. Much cheaper than a credit card or other source.

- If you are not sure you will need a loan, or still waiting for your final insurance settlement, my advice is to apply now, before the May 20th deadline, and decide later. Keep your options open. If you are offered a loan, you have 2 months to decide whether or not you want to accept it. And you can easily decline the loan offer at no cost to you.

- Loan terms can be up to 30 years, with relatively small payments. For example, a $24,000 home loan with a 30-year loan term would only be a little bit over $70 per month.

- If you have a high insurance deductible, SBA disaster loans can be used for that deductible.

- Also, homeowners and businesses can request an additional 20% of the total estimated damage to be used for mitigation–to prevent future damage. (such as a stronger roof, installing a sump pump, a change in landscaping or a retaining wall, or elevating your furnace and hot water heater by several feet so they are not as likely to get damaged by flood water).

- For loans up to $25,000, there is no collateral required and no closing costs. You don’t have to put a lien on your home or business if the loan is $25,000 or less.

- Based on the amount of estimated damage by the SBA inspector and your ability to repay, homeowners can borrow up to $500,000 for home damage; homeowners and renters can borrow up to $100,000 to repair or replace damaged personal property (the contents of the home), and businesses can borrow up to a total of $2 million for a combination of physical damage, mitigation, and also working capital.

- Even if a small business owner or a private, non-profit organization does not have any physical damage, if they had a drop in sales income due to indirect effects of the disaster, they can borrow money to provide working capital to cover monthly expenses until their business is back up to speed.

- For homeowners and renters with damage, it is important to register with FEMA first, to see if you can get any grant money. After registering with FEMA, those above a certain income level may receive a letter saying they have been referred to the SBA for a loan. FEMA may still help with temporary housing and basic repairs if the home is not habitable. However, if someone is referred to the SBA by FEMA, it is very important for them to follow through and apply for a loan, even if they do not want one. If the loan is denied after being referred to the SBA, they may be referred back to FEMA for possible additional grant assistance for basic personal property needs. And if your no-cost SBA loan application is approved, you have 2 months to decide whether you want or need it, and can decline it at no cost to you. (Apply now, before May 20 deadline, decide later.)

- There are several steps in the application process. If you get a letter or learn in the online portal that you have been declined or “withdrawn”, look carefully to see if additional information is needed. Upload the information needed before clicking on the Reacceptance or Reconsideration button online, or give us a call or come visit us at any disaster recovery center, and ask what else is needed.

- Be sure to include all your assets and the income of everyone in your household to demonstrate the ability to repay the loan.

- If a private road or driveway for your primary residence had enough damage that an emergency vehicle cannot reach your home, then you should register with FEMA to see if they can help. Anything not covered by insurance or FEMA may be eligible for an SBA loan.

- SBA Disaster Home Loans are only for one’s primary residence (where you live more than half the year), but if you have a rental property, earn rental income and pay taxes on that rental income (like a regular business), then you can apply for a business disaster loan to cover uninsured damages to your rental property, with an interest rate as low as 4%.

- If you live on an island and your boat and dock are the ‘only’ means you have to access your primary residence (where you live more than half the year), then damage to your boat and dock may be eligible for an SBA disaster home loan. If you can access your home by car, then your boat and dock are likely not eligible.

- If your occupation is in aquaculture (fishing, crabbing, lobstering, etc.), then your privately-owned boat and dock (traps, line, etc.) that you use for your commercial fishing business ‘may’ be eligible for an SBA business loan, as business equipment.